Today? That world is gone. Western governments now demand full transparency. CRS agreements trigger global data exchange. Capital is taxed, tracked, and sometimes frozen — not because you did something wrong, but because regulators want control.

And in this new global reality, Dubai is emerging not as a loophole — but as a sovereign fortress. Welcome to the age of real assets, with real control.

1. 0% Tax on Rental Income, Capital Gains, and Inheritance

✅ All real estate income — including Airbnb — is tax-free

✅ No capital gains tax on resale

✅ No wealth tax or inheritance tax under UAE law

✅ No annual property tax or holding levy

You earn, hold, and exit — with no erosion.

2. Selective CRS Participation = Global Privacy

While Switzerland now participates fully in CRS, the UAE does not.

Dubai does not report tax information to countries like the United States, Turkey, and much of Latin America and Asia.

No automatic exchange of information = strategic privacy, without secrecy.

3. Real Assets > Fragile Banks

Bank accounts freeze.

Markets crash.

But a villa in Dubai doesn’t vanish.

Your property sits in your name, on government records, with escrow protection — and no third-party can touch it.

4. Hold Property via Trusts, SPVs, and Offshore Entities

You can legally own Dubai real estate via:

- RAK ICC holding company

- DIFC private wealth foundation

- Mauritius or BVI offshore structure

- UAE onshore SPV

That means: estate protection, privacy, and legal flexibility — without risk.

5. Residency by Investment — Fast and Clean

Buy property worth AED 750,000+ and:

- Get 2–10 year UAE residency

- Include spouse + children

- No language test, no “points system”

- Corporate-owned property? Still eligible

Dubai is one of the only places where owning equals belonging.

6. AED Pegged to USD Since 1997

The Emirati Dirham is permanently pegged at 3.6725 to the US Dollar.

No floating currency. No unexpected shocks.

Your capital stays dollar-aligned — in a real estate market insulated from currency devaluation.

7. No Capital Controls, No Exit Restrictions

You can:

- Wire funds in or out

- Repatriate rent, profit, or resale proceeds

- Hold in multi-currency bank accounts in AED, USD, EUR

No conversions. No approvals. No friction.

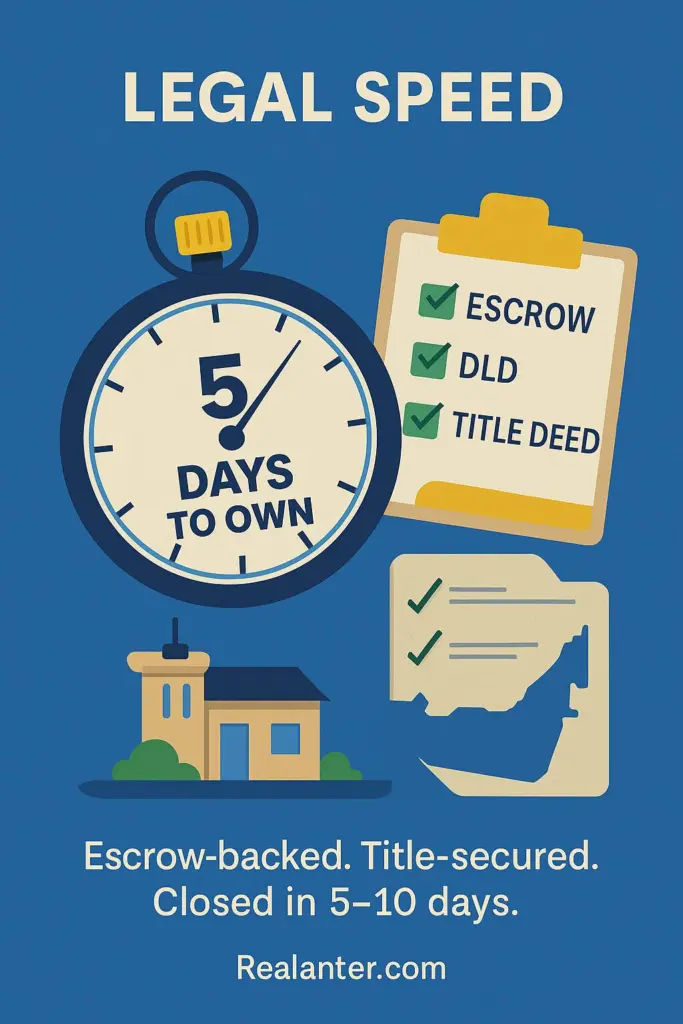

8. Escrow-Regulated, Legally Transparent Transactions

Every deal is:

- Digitally recorded via the Dubai Land Department

- Funded through licensed escrow accounts

- Processed in 3–10 business days

And title deeds are blockchain-backed for lifetime verification.

9. Politically Neutral, Economically Independent

Dubai is not aligned with EU or US sanctions.

It hasn’t confiscated foreign assets — ever.

While Europe and the US froze capital, Dubai remained legally neutral and economically active.

10. Not a Tax Haven. A Sovereign Asset System.

Dubai is fully regulated.

But it’s not overregulated.

You get:

- No property registration in global public databases

- No forced declaration of offshore property

- No residency reporting back to your home tax system

Just clean, structured ownership — on your terms.

💡 Real-World Investor Case Studies

🇧🇷 From Swiss Bank to Downtown Tower

Brazilian investor moved $8M from Geneva into 3 DIFC units via RAK ICC.

Now earns tax-free USD-denominated yield + Golden Visa residency.

🇮🇳 Family Office Diversification

Mumbai-based trust placed assets into 3 townhouses in Jumeirah Golf.

Held through a DIFC private wealth foundation with multiple signatories.

🇺🇦 From Risk to Real Estate

Ukrainian family shifted $3.4M post-conflict into Dubai Hills property.

Fully held via SPV. Zero exposure to EU asset tracking.

🇿🇦 From Currency Collapse to Capital Freedom

South African client exited Johannesburg’s banking sector with $1.6M

→ reinvested into Bluewaters Island property with full dollar liquidity.

🔐 Final Word: Dubai Is the New Vault — With Keys You Control

✅ No tax.

✅ No exposure.

✅ No interference.

Dubai doesn’t offer invisibility.

It offers control — backed by real law, real land, and real leverage.

And in 2025 and beyond, the best wealth isn’t hidden.

It’s protected. Positioned. And free.

FAQ

Yes. There is no income tax, capital gains tax, or inheritance tax on real estate in Dubai — for residents and non-residents alike.

Absolutely. Investors often use RAK ICC, BVI entities, DIFC foundations, or family offices for asset protection, privacy, and estate planning.

The UAE participates selectively. It does not exchange tax information with countries like the United States and several others, making Dubai property a preferred jurisdiction for strategic privacy.

Yes. If you purchase property worth AED 750,000+, you’re eligible for 2–10 year UAE residency, including family sponsorship — with no language or point system.

With prepared documents and funds, deals close in 3 to 10 business days. Dubai real estate is escrow-regulated, blockchain-verified, and legally protected by the Dubai Land Department.